Transportation Impact Fees (TIF)

The City uses several tools to meet those needs to help spread the costs equitably and over time. These tools include the quarter-cent sales tax, which goes toward maintenance of existing streets; the half-cent sales tax, which is administered by the Georgetown Transportation Enhancement Corporation; and the property tax-based bond programs.

A transportation impact fee (TIF) is a charge assessed on new development to pay for the construction or expansion of roadway system facilities that are necessitated by and benefit that new development. Impact fees help address the need for increased capacity on roadways that serve the overall transportation system as Georgetown continues to grow.

On this page, you will find information about how to stay informed, the study, the timeline, and answers to frequently asked questions.

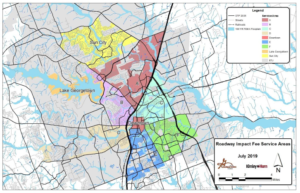

TIF Region Map

Calculate Fees

Download this handy TIF calculator to compute fees.

Process and Timeline

Any plat for a development submitted on or after March 1, 2023, will be required to provide TIF.

Legal lots that do not require platting will be required to submit TIF according to when the building permit application is submitted.

The impact fees will be determined with site plans or construction plans.

TIF will be collected at the time building permits are requested.

TIF will be applied to any development within the City limits or developments that have been annexed.

Change in Use – Industrial

Shell buildings will be required to pay fees according to the zoning of the parcel. Impact fees will be reassessed when an applicant applies for tenant finish out. The applicant will be required to pay the difference in use.

Developments within the ETJ – Outside City Limits

Developments outside the City limits with an ADT of 1000 or greater will be required to submit a TIA according to UDC 12.06

Frequently asked questions

Below are answers to frequently asked questions about this process. If you can’t fine your answer submit a question in the comment box at the bottom of this page.

Staff and City Council are working to have robust public involvement throughout this process. In addition to public meetings (see the Timeline below), the City holds biweekly conference calls with developers and builders and will have meetings with engineering, builder, and developer organizations and committees

The best way to stay informed about this process is by adding your email address to our distribution list. We will send regular emails to stakeholders – including landowners, builders, developers, and consultants – to notify and remind you of important dates, input opportunities, website updates, and more.

To be added to this list, please fill out the comment box above.

Currently, development impacts to Georgetown’s transportation network are governed under the City of Georgetown’s Unified development Code Section 12.09, which requires the City to complete a Traffic Impact Analysis (TIA) for all projects are expected to generate at least 2,000 vehicle trips per day. Our current TIA process has some challenges, including equitable application of the code, time, and costs across different developments.

To address these concerns, City Council on Jan. 22, 2019, directed staff to conduct a study on the feasibility of transportation impact fees in Georgetown. The impact fee study will evaluate the development and implementation of a transportation impact fee in accordance with Chapter 395 of the Texas Local Government Code.

During most of 2019, staff and Kimley Horn and Associates undertook the efforts of building a preliminary Transportation Impact Fee (TIF) Study. This work included the following:

- Service Area Map

- Preliminary TIF Report (including Land Use Assumptions and Capital Improvement Plan)

- Tentative Transportation Impact Fee Schedule

- Draft Final Report

- Maximum Calculated Fee Exhibit

- Impact Fee Committee Recommendations

- Transportation Impact Fee Study Final Report – Feb. 2021_Part1

- Transportation Impact Fee Study Final Report – Feb. 2021_Part2

Nov. 26, 2019 | City Council workshop: Impact Fees 101 and Service Areas

Feb. 25, 2020 | City Council meeting: Establish Transportation Impact Fee Advisory Committee

Committee members

- Sheila Mills, board chair

- Ercel Brashear, board member

- George Brown, board member

- James Hougnon, board member

- Bryan Hutchinson, board member

- Dan Jones, board member

- Michael Miles, board member

- Robert Redoutey, board member

- Angela Newman, vice president, Trio Development

- John Tatum, Austin development manager, Hillwood Communities

- Stephen Ashlock, vice president of Land Development, Pulte Group

- Adib Khoury, land manager, D.R. Horton

March 13, 2020 | GTAB-Transportation Impact Fee Advisory Committee Meeting: Impact Fee 101

Summer 2020 | Meetings delayed due to COVID-19 concerns

Sept. 8, 2020 | City Council Meeting: Set date for public hearing on land use assumptions and capital improvement plan.

Sept. 11, 2020 | GTAB-Transportation Impact Fee Advisory Committee: Impact Fee 101 refresher, Land Use Assumptions, and Capital Improvement Plan

View the recording here (Passcode: s9W+8JiV)

Sept. 30, 2020 | Georgetown Chamber of Commerce Developer Alliance meeting

Oct. 27, 2020 | City Council Meeting: Public Hearing on Land Use Assumptions and Capital Improvement Plan

View the recording here (Item AD)

Nov. 13, 2020 | GTAB-Transportation Impact Fee Advisory Committee Meeting

Dec. 2, 2020 | Georgetown Chamber of Commerce Development Alliance meeting

Dec. 11, 2020 | GTAB-Transportation Impact Fee Advisory Committee Meeting

Jan. 8, 2021 | GTAB-Transportation Impact Fee Advisory Committee Meeting

Jan. 12, 2021 | City Council Meeting: Set date for Public Hearing on Transportation Impact Fee Study

Feb. 9, 2021 | City Council Workshop: Transportation Impact Fee Committee Summary and Recommendation on the Impact Fee Study

Feb. 23, 2021 | Council Workshop: Final Recommendations and Revisions

Feb. 23, 2021 | City Council Meeting: Public Hearing on the Transportation Impact Fee Study

March 9, 2021 | City Council Meeting: Continuation of Public Hearing from February 23, 2021 on Transportation Impact Fees

March 9, 2021 | City Council Meeting: Consideration and possible first reading of an Ordinance adopting/establishing Transportation Impact Fees

March 23, 2021 (tentative) | City Council Meeting: Consideration and possible second reading of an Ordinance adopting/establishing Transportation Impact Fees

Effective date | The Impact Fee Advisory Committee has recommended City Council establish an effective date of Oct. 1, 2022. Council has directed the effective date for initial collection of fees be March 1, 2023 in order to provide almost two full years of grace period to the development community, which is almost double the minimum required by state law.

What are Transportation Impact Fees?

A Transportation Impact Fee is a charge assessed on new development to pay for the construction or expansion of roadway system facilities that are necessitated by and benefit that new development. These fees would help fund transportation improvements that will be needed as development occurs in Georgetown.

Chapter 395 of the Texas Local Government Code defines an impact fee as a “charge or assessment imposed … against new development in order to generate revenue for funding or recouping the costs of capital improvements or facility expansions necessitated by and attributable to the new development.”

Why is Georgetown looking into Transportation Impact Fees?

Georgetown is evaluating the Transportation Impact Fee as an additional tool to help cover the cost of expanding its street infrastructure in response to new growth. A Transportation Impact Fee Program would provide a means for the City to require new development to pay toward roadway infrastructure improvements in a manner that is proportional to the development’s impact.

What are Transportation Impact Fee funds used for?

Transportation Impact Fees would be used to recover the costs associated with the expansion of the transportation network necessary to serve demands generated by new development. The funds can be used for planning, surveying, engineering, land acquisition, and construction. Impact fees may not be used to remedy existing transportation deficiencies.

What are Transportation Impact Fees NOT used for?

Transportation Impact Fees may not be used to repair or maintain existing facilities, upgrade or replace existing capital improvements to serve existing development, or pay for administrative or operating costs to impose the fees. This does not preclude inclusion of roadway widenings; however, so long as the cost of that roadway is discounted to account for roadway capacity serving existing demands.

Who would pay Transportation Impact Fees?

Any applicant who is seeking a building permit for a new development (residential or commercial) that will generate additional use of roadway will be responsible for paying a Transportation Impact Fee. Applicant means any person, company, agency, or entity that is undertaking a development project. Public schools are exempt from Transportation Impact Fees.

Would redevelopment pay a fee?

Since Street Impact Fees are traffic-dependent, a redevelopment project that generates more traffic than the existing development would be subject to a Street Impact Fee. However, that fee would be based only on the traffic generated in excess of what was being generated by the previous development. If the new development generates an equal or lesser amount of traffic when compared to the previous development, it would not be subject to a fee.

Do roadway impact fees only apply in city limits?

Yes.

What happens in the Extraterritorial Jurisdiction (ETJ)?

Roadway impact fees are not applicable in the ETJ. If a property is annexed, there could be a requirement to update the impact fee with annexation.

What happens if the land-use changes after the initial building permit?

A: Roadway Impact Fees are based on the amount of traffic generated. If the traffic increases, the net increase of traffic could be charged a fee. Several cities set a policy to not charge a change of use impact fee unless the traffic increase a designated number of times.

For “shell buildings,” developers do not always know the tenants until after the building is complete. In these cases, the most common land uses are typically utilized (office, industrial, retail). If the build-out permit is more intense, the delta is charged.

Is there grandfathering of current developments?

State law requires a one-year grace period for previously platted properties. A property that does not have to plat would likely receive a one-year grace period as well. After that period of time, the development would be subject to a fee. This will be considered further in the ordinance development of the roadway impact fee.

Are the roadway impact fees the same for multifamily and single-family homes?

No, rates are different because they produce different amounts of trips. Multi-family would pay a different rate.

How are TxDOT roads accounted for?

The study currently assumes a 20 percent City contribution to the cost of TxDOT facilities.

How are County roads accounted for?

County roads are typically in the ETJ and not city limits. As a result, County roads are not in this study.

How do impact fees interact with MUDs, TIRZ, and other development agreements? (from Sept. 30, 2020, Chamber Georgetown Development Alliance meeting)

Offset agreements can be developed for any previous contributions eligible towards impact fees otherwise due.

Are all the projects in the CIP scaled appropriately? Are any of the projects “over built,” calling for a larger improvement than necessary during the 10-year period? For example, is there a project calling for a six-lane road, when a four-lane road is sufficient to accommodate growth over the next decade? (Home Builders Association questions submitted via email)

Yes, projects are scaled to fit the anticipated 10-year time frame. Westinghouse Road in Service Areas E & F in the 10-year Transportation Impact Fee (TIF) CIP transitions from a projected six-lane arterial on the west side of FM 1460 (Projects E-19 thru E-24) to a four-lane arterial on the east side of FM 1460 (Project E-25) that acknowledges the full six lanes are not necessary in the 10-year window.

Furthermore, the recoverable costs of projects are capped by the 10-year growth, and thus the proportion of costs for all the projects in a given service area that are beyond the 10-year growth needs (established in the Land Use Assumptions) is not included in the resulting maximum fees per service area.

Do any of the projects call for the replacement of existing lanes/roadway capacity? (Home Builders Association questions submitted via email)

Yes. Implicitly widening projects include replacement of existing lanes being used today. The cost of replacing capacity for existing demand is accounted for in the maximum fee calculation based on traffic counts collected in 2019 for this project on roadway project alignments. The recoverable cost used to calculate the maximum assessable fee does not include this portion of the cost.

Will the City be able to build out all of the projects in the CIP? If not, the projects should be prioritized and the number of projects reduced, resulting in a lower impact fee. (Home Builders Association questions submitted via email)

Inherent in the impact fee program is that development will build some of the projects in the CIP and get offsets for fees otherwise due, rather than paying the fee for the City to complete projects. It is not anticipated that the City will build all the projects in the CIP, but rather the projects in the CIP that are included are anticipated to be needed to serve development during the next 10 years. Further, the recoverable cost of the CIP that is used to calculate the maximum assessable fee is limited by the anticipated growth in the Land Use Assumptions over the 10-year period. Therefore, reducing the projects would not accurately reflect the needed capacity and is not recommended.

What if a development constructs an improvement not on Impact Fee CIP map used to develop impact fee, does that count toward impact fee credit?

If it’s a local road or site-specific road, no. However, if it’s a collector or arterial system facility that can be amended to the Overall Transportation Plan, yes.

Who is on the Impact Fee Advisory Committee (IFAC)?

The Impact Fee Advisory Commission (IFAC) serves in advisory capacity to the City Council regarding impact fees. The IFAC advises and assists the Council in adopting land use assumptions, reviews the Capital Improvements Plan, and monitors its implementation. All regular members of the Georgetown Transportation Advisory Board (GTAB) serve on the IFAC, and additional ad hoc members may be appointed by the City Council.

When would a roadway impact fee be due?

The roadway impact fee would be paid when the application is issued a building permit, at the rate at which Council sets.

Impact fees are assessed at plat (locks in rate schedule at this date) and collected at building permit.

What if these Transportation Impact Fees get increased in the future?

Impact Fees cannot be increased without a public hearing process per state law. The Impact Fee Advisory Committee looks at the progress of the program every six months and can advise staff on the program’s status. The study will be updated every five years at a minimum per state law

Is there a process to appeal or dispute roadway impact fees assessed? (from Sept. 30, 2020, Chamber Georgetown Development Alliance meeting)

Yes, Chapter 395 of the Local Government Code has provisions allowing for an appeals process, which can be further specified in an ordinance.

How is debt issued for projects? (from Sept. 30, 2020, Chamber Georgetown Development Alliance meeting)

Project debt issuance is independent of the impact fee study, but there are baseline assumptions about how projects will be debt-financed in the financial credit calculation, which has not been completed at the time of this question. The City of Georgetown finance department will provide the length, assumed interest rates, and other information needed to determine the net financing cost of projects.

In the event there is a surplus left over, does that money stay in that box for that service area or does it get transferred elsewhere?

Fees collected must be spent within 10 years within the Service Area collected. If the money is not spent in 10 years, the fees collected must be refunded to the building permit applicant. The study is updated at least every five years. During the update, the existing balance is examined to ensure it is spent before the time limit expires.

How were the construction costs calculated? Is the City using models that reflect real-world costs? Where were the costs estimates derived from? (Home Builders Association questions submitted via email)

Construction costs are conceptual planning level costs but include detailed quantities and line items for construction components and allowances for elements related to the construction of roadway facilities. Unit costs and percentage allowances are based on projects bid recently in the City of Georgetown in the last two to three years. The appendix to the draft report (under About the study above) includes a detailed planning level cost projection for each project in the TIF CIP.

Contact Us

To submit a question or comment or be added to our email distribution list, please fill out the form below.